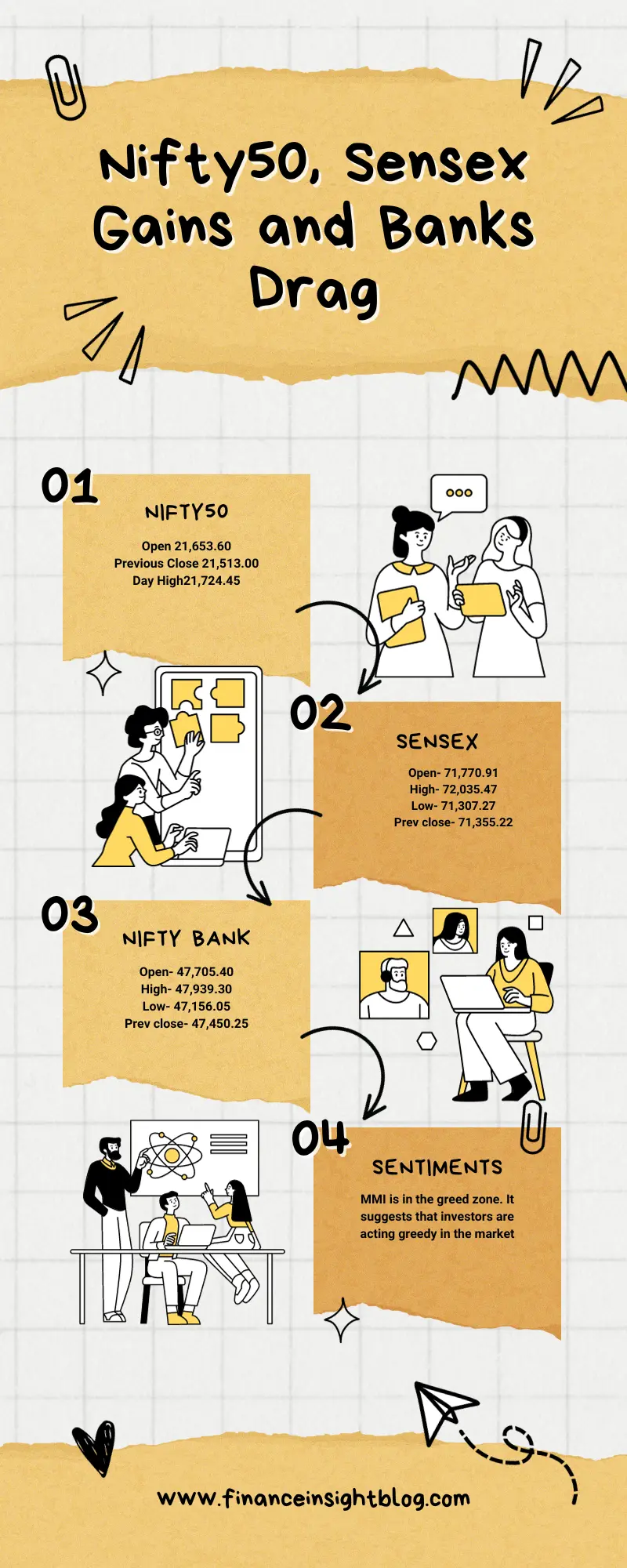

Navigating Market Turbulence: Nifty50, Sensex Gains and Banks going down

Navigating Market Turbulence, As the stock market continues to experience volatility and uncertainty, it is crucial for investors to navigate these market turbulences effectively. In recent times, we have witnessed both the Nifty50 and Sensex rebounding sharply after a significant fall. This article aims to provide insights into the factors driving these gains and the simultaneous decline in the banking sector.

Understanding the Recent Market Trends

The recent market trends have been characterized by a mix of positive and negative movements. While certain sectors, such as IT stocks and auto major Bajaj Auto, have witnessed buying action, the banking sector has faced a decline. This divergence in performance can be attributed to various factors influencing investor sentiment.

Latest data can be tracked under https://www.google.com/finance/ .

Factors Driving the Gains

One of the key factors contributing to the gains in the Nifty50 and Sensex is the increased buying activity in IT stocks. The pandemic has accelerated the digital transformation across industries, leading to a surge in demand for IT services. This trend has positively impacted the performance of IT companies, resulting in their stocks gaining traction in the market.

Additionally, the auto sector, represented by Bajaj Auto, has also witnessed buying interest. With the gradual easing of lockdown restrictions and the resumption of economic activities, there has been a revival in consumer demand for automobiles. This has translated into improved financial performance for auto companies, thereby driving their stock prices higher.

Volatility Indicator: India VIX

India VIX, a volatility indicator, has eased by 4% in recent times. This indicates a decrease in market volatility and suggests a relatively stable market environment. Investors often view a decline in volatility as a positive sign, as it reduces the uncertainty associated with market movements.

Understanding the Banking Sector Decline

While the broader market has witnessed gains, the banking sector has experienced a decline. This can be attributed to several factors impacting investor sentiment towards banks.

High Valuations and Expectations of Corrections

One of the primary reasons for the decline in the banking sector is the perception that the present high valuations are difficult to sustain. Investors have become cautious about the sustainability of the current market levels and anticipate the possibility of sharp corrections in the near future.

This cautious sentiment is reflected in the increasing short positions being built up by investors. Short positions are essentially bets on the decline in stock prices. The rising number of short positions indicates bearish expectations regarding the banking sector and the broader market.

Triggers for Potential Corrections

Investors are also concerned about potential triggers that could lead to sharp corrections in the market. These triggers could include factors such as geopolitical tensions, economic uncertainties, or adverse policy decisions. The anticipation of such triggers has led investors to take a cautious approach and reduce their exposure to the banking sector.

Navigating Market Turbulence

Given the current market conditions, it is essential for investors to navigate market turbulence effectively. Here are a few strategies that can help investors in this regard:

1. Diversification

Diversifying your portfolio across different sectors and asset classes can help mitigate the impact of market volatility. By spreading your investments, you reduce the risk associated with any single sector or stock.

2. Fundamental Analysis

Conducting thorough fundamental analysis of the companies you invest in can provide valuable insights into their financial performance and growth prospects. This analysis can help you make informed investment decisions and identify companies that are better positioned to weather market turbulence.

3. Regular Monitoring

Stay updated with market news and developments to make informed decisions. Regularly monitoring your portfolio and adjusting your investment strategy based on changing market conditions can help you navigate market turbulence effectively.

4. Consult with Financial Advisors

If you are unsure about navigating market turbulence on your own, consider seeking advice from financial advisors. They can provide personalized guidance based on your financial goals and risk tolerance, helping you make informed investment decisions.

Navigating Market Turbulence: Conclusion

While the recent gains in the Nifty50 and Sensex have provided some respite to investors, it is essential to remain cautious amidst the decline in the banking sector. By understanding the factors driving these market movements and adopting effective strategies, investors can navigate market turbulence and make informed investment decisions.

To understand market behaviour please read blog : https://financeinsightblog.com/10-mind-blowing-ways-financial-news-impacts-stock-market-trends/ .

Highlights of trade:

- Jyoti CNC Automation IPO opens today

- ZEE crashes 10% on possibility of Sony merger being called off

- Bajaj Auto jumps 4% on $482 million buyback plan